CITIC PE

-

DATABASE (35)

-

ARTICLES (14)

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

A private equity arm of China state-backed conglomerate CITIC Group Corp., CITIC Private Equity Funds Management (also known as CITIC PE or CPE) is one of the largest PE investors in China. It was founded in June 2008, managing over RMB 100bn worth of assets including private equity, mezzanine and public market funds. With over 200 investors from home and abroad, CPE focuses on investment opportunities in diverse sectors like healthcare, consumer goods, Internet, technology, software, enterprise tech and real estate. The firm has made investments in more than 100 enterprises.

Citic Private Equity Funds Management

A private equity arm of China state-backed conglomerate Citic Group Corp., CITICPE is one of the largest PE investors in China, with RMB 9 billion under management.

A private equity arm of China state-backed conglomerate Citic Group Corp., CITICPE is one of the largest PE investors in China, with RMB 9 billion under management.

Founded in October 1995, CITIC Securities is China's first securities company listed in Shanghai and the Hong Kong. CITIC is its major shareholder, with 15.47% stake in it. The company provides services from securities trading, brokerage, asset management to investment banking. In 2013, CITIC Securities acquired CLSA to extend its international businesses. With branches in 13 countries and regions, it now has over 40,000 business clients and more than 10.3m individual customers home and abroad.

Founded in October 1995, CITIC Securities is China's first securities company listed in Shanghai and the Hong Kong. CITIC is its major shareholder, with 15.47% stake in it. The company provides services from securities trading, brokerage, asset management to investment banking. In 2013, CITIC Securities acquired CLSA to extend its international businesses. With branches in 13 countries and regions, it now has over 40,000 business clients and more than 10.3m individual customers home and abroad.

Yingke PE was founded in 2010 and is headquartered in Shanghai. By the end of 2020, it had managed assets worth nearly RMB 50bn. In May 2021, it closed the RMB 10bn Yingke Science & Technology Innovation Industrial Fund. Over 90% of its funds come from financial institutions, state-owned enterprises and listed companies. Yingke PE has invested in more than 200 companies, focusing on biopharmaceuticals, core technology and upgraded consumption. Since its founding, the company has exited 53 projects, with an internal rate of return up to 54%.

Yingke PE was founded in 2010 and is headquartered in Shanghai. By the end of 2020, it had managed assets worth nearly RMB 50bn. In May 2021, it closed the RMB 10bn Yingke Science & Technology Innovation Industrial Fund. Over 90% of its funds come from financial institutions, state-owned enterprises and listed companies. Yingke PE has invested in more than 200 companies, focusing on biopharmaceuticals, core technology and upgraded consumption. Since its founding, the company has exited 53 projects, with an internal rate of return up to 54%.

Goldstone Investment was founded in 2007. It is a branch company of CITIC Securities.

Goldstone Investment was founded in 2007. It is a branch company of CITIC Securities.

Founder and Chairman of Citybox

Founder and chairman of Citybox. Wang graduated from Fudan University and has many years of experience in consulting and private equity buyout. He was formerly partner at CITIC Capital. Wang is the co-founder of Fruitday, an e-commerce fruit seller, and a shareholder in the biggest imported shopping mall in Shanghai, CityShop.

Founder and chairman of Citybox. Wang graduated from Fudan University and has many years of experience in consulting and private equity buyout. He was formerly partner at CITIC Capital. Wang is the co-founder of Fruitday, an e-commerce fruit seller, and a shareholder in the biggest imported shopping mall in Shanghai, CityShop.

Founded in 2010, Greenwoods Investment has invested in over 60 startups, with three RMB-denominated PE funds and two USD PE funds under management.

Founded in 2010, Greenwoods Investment has invested in over 60 startups, with three RMB-denominated PE funds and two USD PE funds under management.

Co-founder of Infinited Fiber

Ali Harlin completed two doctorates in chemical engineering and in polymer science in 1995 and 1996 respectively. He spent 11 years developing the Borstar technology related to bimodal PE and PP. He has also worked as a research director for packaging materials and cable machinery. He currently works as a research professor and lecturer at two local universities in Finland. In 2003, he joined Tampere University of Technology as a professor for fiber materials and technical textiles. In 2014, he also started lecturing at LUT University as a professor specializing in packaging and polymeric materials.Since 2005, the industrial biomaterial specialist has also been working at the Technical Research Centre of Finland VTT where he became the product R&D team leader for Infinited Fiber, a startup he co-founded in 2016 with CEO Petri Alava.

Ali Harlin completed two doctorates in chemical engineering and in polymer science in 1995 and 1996 respectively. He spent 11 years developing the Borstar technology related to bimodal PE and PP. He has also worked as a research director for packaging materials and cable machinery. He currently works as a research professor and lecturer at two local universities in Finland. In 2003, he joined Tampere University of Technology as a professor for fiber materials and technical textiles. In 2014, he also started lecturing at LUT University as a professor specializing in packaging and polymeric materials.Since 2005, the industrial biomaterial specialist has also been working at the Technical Research Centre of Finland VTT where he became the product R&D team leader for Infinited Fiber, a startup he co-founded in 2016 with CEO Petri Alava.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

One of the first independent PE firms in China, with US$1.5 billion currently under management, Capital Today mainly invests in companies targeting China’s booming middle class.

One of the earliest PE firms in China focusing on growth-stage investment in high-tech companies. With RMB 20 billion under management, Tsing-yuan Captial has invested in 170+ companies.

One of the earliest PE firms in China focusing on growth-stage investment in high-tech companies. With RMB 20 billion under management, Tsing-yuan Captial has invested in 170+ companies.

Tongfang Holch conducts direct investment, angel investment, PE investment and NEEQ investment with billions of RMB under management. It is one of the fastest-growing PE investment firms in China.

Tongfang Holch conducts direct investment, angel investment, PE investment and NEEQ investment with billions of RMB under management. It is one of the fastest-growing PE investment firms in China.

Founded by Matt Hu (former head of asset management, China Securities) and John Wu (ex-Alibaba CTO and angel investor), Fenghe runs its PE/VC and hedge fund businesses out of Singapore and Shanghai.

Founded by Matt Hu (former head of asset management, China Securities) and John Wu (ex-Alibaba CTO and angel investor), Fenghe runs its PE/VC and hedge fund businesses out of Singapore and Shanghai.

Founded in 2007, the Shenzhen-based CDF Capital runs a RMB 4.2 billion PE fund for investments in new materials, new IT, consumer, cleantech and healthcare tech sectors. It has backed over 120 companies to date.

Founded in 2007, the Shenzhen-based CDF Capital runs a RMB 4.2 billion PE fund for investments in new materials, new IT, consumer, cleantech and healthcare tech sectors. It has backed over 120 companies to date.

One of the earliest VC/PE firms in China, Shenzhen GTJA Investment focuses on the healthcare/biotech industry. It manages about RMB 10 billion and has invested in more than 100 companies since its inception in 2001.

One of the earliest VC/PE firms in China, Shenzhen GTJA Investment focuses on the healthcare/biotech industry. It manages about RMB 10 billion and has invested in more than 100 companies since its inception in 2001.

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

China's Yuanfudao now the world's most valuable edtech with $2.2bn new funding

Yuanfudao’s second tranche of its Series G funding follows the $1bn it raised in March, bringing its valuation to $15.5bn

Drone Hopper: Firefighters of the future

A senior Airbus engineer from Spain has developed heavy-duty autonomous drones to quell wildfires safely

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

Chinese startups feel the chill of capital winter as VC activities slow

The goods news is investors still have plenty of money. They just become more cautious when making investment decisions

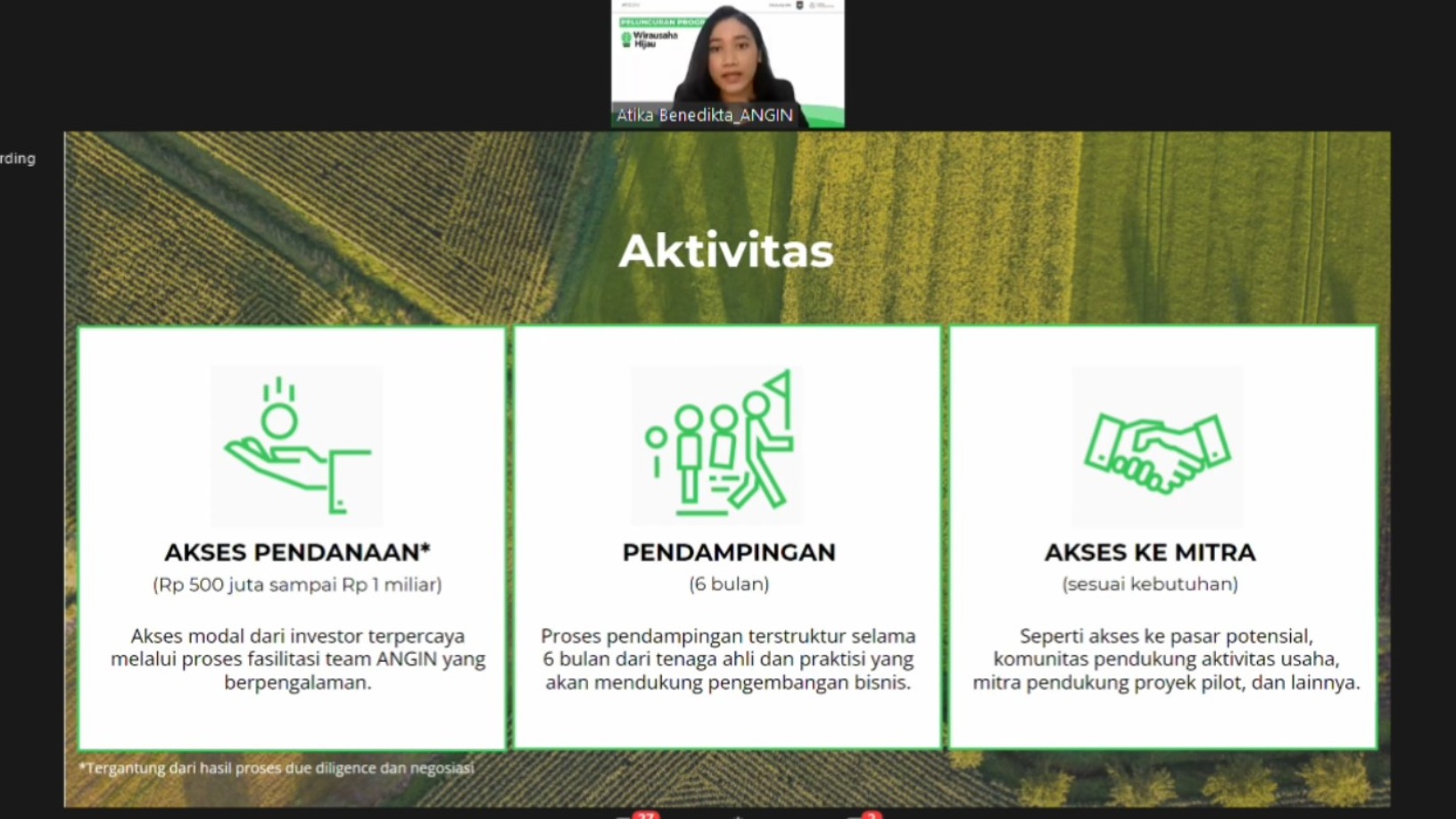

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Gorry Holdings: Promoting staff wellness in Indonesia

The healthtech startup wants companies to understand how healthy employees can translate into good business

Bernardo Hernández: Celebrity investor and Google's former marketing whiz

The angel investor behind some of the most successful Spanish internet startups also has an unusual honor for techies – GQ’s Man of the Year

How Sequoia Capital China is helping its portfolio startups get through the Covid-19 crisis

The renowned investor is also making big bets on the opportunities that lie head

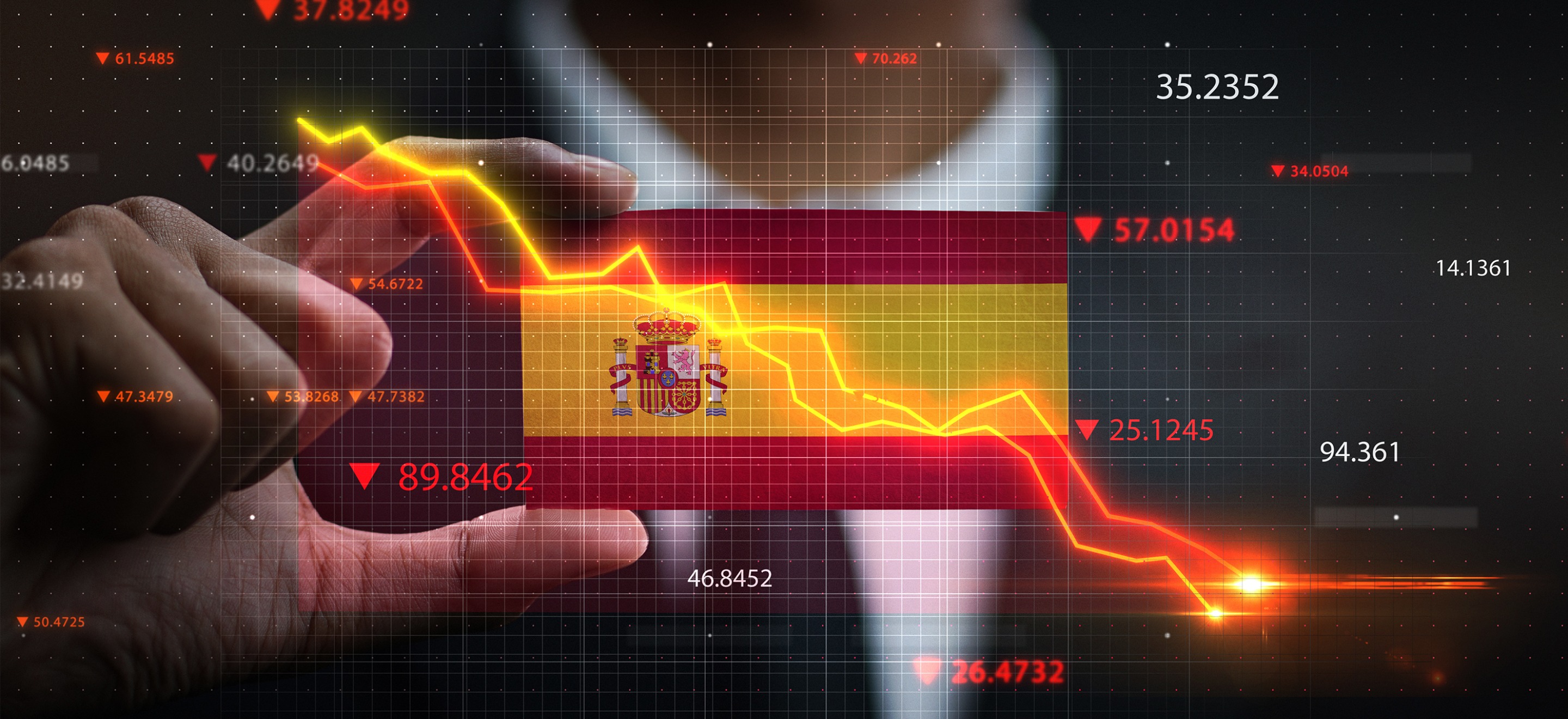

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

“From a record year to a tragic year” – Investor Eneko Knorr on Spain’s 2020 startup funding

Startups should focus on profitability but for investors with leeway, there are still great opportunities, says Spanish angel investor Eneko Knorr. He shares his outlook, top picks and advice on riding out the Covid-19 crisis

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

Spanish startups and investors rethink strategies as Covid-19 hits funding, valuations

Investors and startups in Spain say most funding has stalled, and share their strategies and advice for coping with the downturn

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

Sorry, we couldn’t find any matches for“CITIC PE”.